tax lien nj foreclosure

The county at their discretion can attach. Tax lien foreclosure is the sale of a property resulting from the property owners failure to pay their tax liabilities.

Circuit Split On Avoidance Of Tax Foreclosure Sales Will Supreme Court Settle The Issue New Jersey Law Journal

Tax liens are only secured to the extent that there is value in the property in question.

. Although every foreclosure case is different below are the general steps in the timeline of foreclosure in New Jersey. Thus a previously recorded mortgage has priority over subsequent liens recorded against the property with one critical exception when a tax. Or If you do not have an assigned caseworker email the Judgments Unit at judgmentstaxationtreasnjgov.

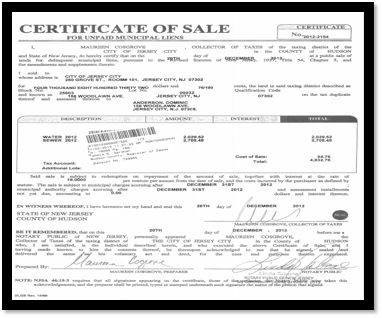

New Jersey tax lien buyers have to wait two years before they can proceed with a tax lien foreclosure if the property is occupied but if the property is vacant there is no required redemption period before initiating the foreclosure process. Foreclosure of a TSC extinguishes the right of the property owner or any mortgage holder to redeem. 545-891 with the amendment preventing investors who purchase homes subject to a tax foreclosure for below fair market value from intervening in foreclosure actions to redeem those properties.

Once a property owner fails to make property tax payments as required by New Jersey law the property may eventually subject to a New Jersey Tax Foreclosure. There are currently 1569 red-hot tax lien listings in Wildwood NJ. If you purchase a property at a foreclosure auction and later find that there is a government lien or lien that survives the foreclosure auction you will be responsible and indebted.

In fact the rate of return on property tax liens investments in Montclair NJ can be. The procedures that govern tax foreclosure are set down in the Tax Sale Law NJSA. 1999 the Appellate Division confirmed that NJSA.

The lender or servicing company can begin the foreclosure process once there are past due payments. Contact your assigned caseworker for instructions. Tax lien foreclosures are governed by statute in New Jersey.

Tax 136 Tax Ct. During this 2-year period and during the foreclosure case the investor must pay all the property taxes assessed by the municipality. Most states require a lengthy wait from the purchase of the tax lien certificate to the right to foreclose.

When a municipality purchases the TSC the action to foreclose the right of redemption may be filed at any time after the expiration of six months from the date of sale. 545-79 authorizes the filing of a tax lien foreclosure beyond 20 years when the holder has paid all. When a municipality purchases the TSC the action to foreclose the right of redemption may be filed at any time after the expiration of six months from the date of sale.

These tax foreclosed homes are available for pennies on the dollar - as much as 75 percent off full market price and more. In fact the general rule in New Jersey for tax lien priority is the first filed document has the greater right. What a tax lien sale is like.

City of Perth Amboy Tax Collector 260 High St Perth Amboy NJ 08861 Phone 732826-0290 Ext. Tax lien foreclosure in New Jersey is generally a strict foreclosure process whereby the final judgment is recorded as a deed and the lien holder becomes the owner without a Sheriffs Sale. If you need a Release or Subordination of Tax Lien for refinance or foreclosure of real estate.

In Rem Tax Foreclosure Act 1948. There are currently 287 tax lien-related investment opportunities in Montclair NJ including tax lien foreclosure properties that are either available for sale or worth pursuing. Secured and Unsecured Tax Liens.

Northfield NJ 08225 609 646-0222. To bar the right of redemption and to foreclose all prior or subsequent encumbrances granting the successful party an estate in fee simple upon the recording of the judgment. If your property taxes are delinquent you could lose your property to a tax lien foreclosure or tax deed saleeven if your.

For all others the complaint to foreclose can be filed at any time after the expiration of 2 years. A final judgment of foreclosure entered pursuant to the New Jesey Tax Sale Law NJSA. Tax certificates also have priority over federal tax liens.

In other jurisdictions the taxing authority uses a foreclosure process before holding a sale. 2022 Update NJ Foreclosure Timeline Overview. If a tax lien is put on a debtors home for 40000 but there is only 30000 worth of equity available on the property then 30000 will be secured and 10000 will be unsecured.

Depending on where the property is located past-due property taxes may lead to a tax lien foreclosure or a tax deed sale. The homeowner defaults on their mortgage payments. 1998 affd 318 NJ.

Once the foreclosure deed is recorded and the parties of interest lien holders are notified you will be on the hook. In fact the rate of return on property tax liens investments in New Jersey can be anywhere between 15 and 25 interest. If a property owner fails to make timely property tax payments the property may be subject to tax foreclosure either by the municipality or by a third party who has bought the tax lien from the municipality.

Rinderer 17 NJ. A property owner faces losing his or her property once he or she stops making tax payments or paying sewer and water bills. NJs New Amendment To Tax Foreclosure Law.

The amount of all tax liens accruing subsequent to the tax sale including interest. Foreclosure of a TSC extinguishes the right of the property owner or any mortgage holder to redeem. These one-in-a-lifetime real estate deals are that good.

The tax lien foreclosure process includes some additional protection for property owners. A tax lien foreclosure occurs when the. There is an exception however.

More Harm Than Good. Investing in tax liens in Montclair NJ is one of the least publicized but safest ways to make money in real estate. 4022 Fax 732442-3547 Contact Info City of Perth Amboy Foreclosure Assistance.

In New Jersey once a tax lien is on your home the collector on behalf of the municipality can then sell the property at a public auction subject to your right of redemption see below. Investing in tax liens in New Jersey is one of the least publicized but safest ways to make money in real estate. For all others the complaint to foreclose can be filed at any time after the expiration of 2 years.

In New Jersey the waiting period is two 2 years for private investors. But the bottom line is the same. On September 24 2021 Governor Murphy signed a law amending NJSA.

If the federal government holds an interest in the property such as an IRS federal. New Jersey Tax Sale Certificate Foreclosure is a Tax Lien Foreclosure. 545-1 to -10475 gives full and complete relief.

Indexed in the name of all persons appearing in the tax foreclosure list and the complaint in the same index used. New Jersey gives tax sale purchasers special lien priority.

Settlements Possible In New Jersey Tax Lien Class Action Lawsuit Nj Com

What Happens When Your House Goes Up For Auction Can I Sell My House With A Tax Lien Sell Property For Cash Even If You Owe Delinquent Property Taxes

New Jersey Tax Lien Auction Review Florence Nj Online Sale Youtube

Circuit Split On Avoidance Of Tax Foreclosure Sales Will Supreme Court Settle The Issue New Jersey Law Journal

New Jersey Tax Sales Explained Tax Liens Tax Deeds A Goldmine For Real Estate Investors Youtube

Nj Tax Lien Foreclosure Attorneys

Federal Tax Lien Irs Lien Call The Best Tax Lawyer

A Guide Through The Tax Deed States Are They Legal

Understanding Nj Tax Lien Foreclosure Westmarq

She Owed A Little So They Took Everything How One New Jersey Woman Is Fighting Back Against Unfair Tax Foreclosure Practices Pacific Legal Foundation

Bruce Levitt Wins Tax Lien Foreclosure Appeal Levitt Slafkes Levitt Slafkes P C

Understanding Nj Tax Lien Foreclosure Westmarq

Can I Sell My House A Tax Liens Tax Lien On A Home

The Lien Foreclosure Process Explained For Contractors

What You Need To Know About Unpaid Taxes And Foreclosure

New Jersey Tax Sale Certificate Foreclosure Pscb Law New York And New Jersey Lawyers New Jersey Foreclosure Defense

Otc Tax Liens How We Made 6 In Less Than 120 Days With Tax Liens